Scalable Startup Entrepreneurship Model

Contents:

Scalable startups are less common than small businesses, though they tend to attract a lot of media attention. These businesses begin on a very small scale, often as just the seeds of an idea. This germ is then nurtured and scaled, typically through the involvement of outside investors, until it becomes something much larger. Many Silicon Valley tech companies fall under this model; they begin in an attic, garage, or home office before eventually scaling into large corporate headquarters. As the company matures, the founder’s role is likely to include both long-term strategic planning and short-term tactical management and financial decisions. Startup failure is widespread, with 90% of startups failing within five years.

Be clear that this time is firm, and that you won’t be in touch when you’re away. With this clarity and planning, your team will be prepared to handle business while you recharge. Prioritizing yourself and your family’s needs isn’t selfish—it’s essential for long-term success. If you don’t have a solid foundation, you won’t be able to achieve your highest potential. So set boundaries on your work hours, step away for mid-day school recitals and recharge with personal pursuits that are simply for fun. By giving your real life its due, you can bring fresh energy to your workdays.

It’s a big subject, so I’ll just give an overview here, with links to other articles and series where you can find more detail if you want to. Of course, everyone wants to hire the best, and it helps when you have high growth prospects and/or access to a large pile of venture capital cash. But within your available resources, you can incorporate the startup principle of seeking out the smartest people you can find, and then trusting them to take your business to the next level. Successful startup founders manage to communicate that passion to their staff as well, so that employees become similarly obsessed. Because startups usually have lofty ambitions and innovative methods, it’s easier to energise people than it is with a more traditional business.

Large Business Entrepreneurship

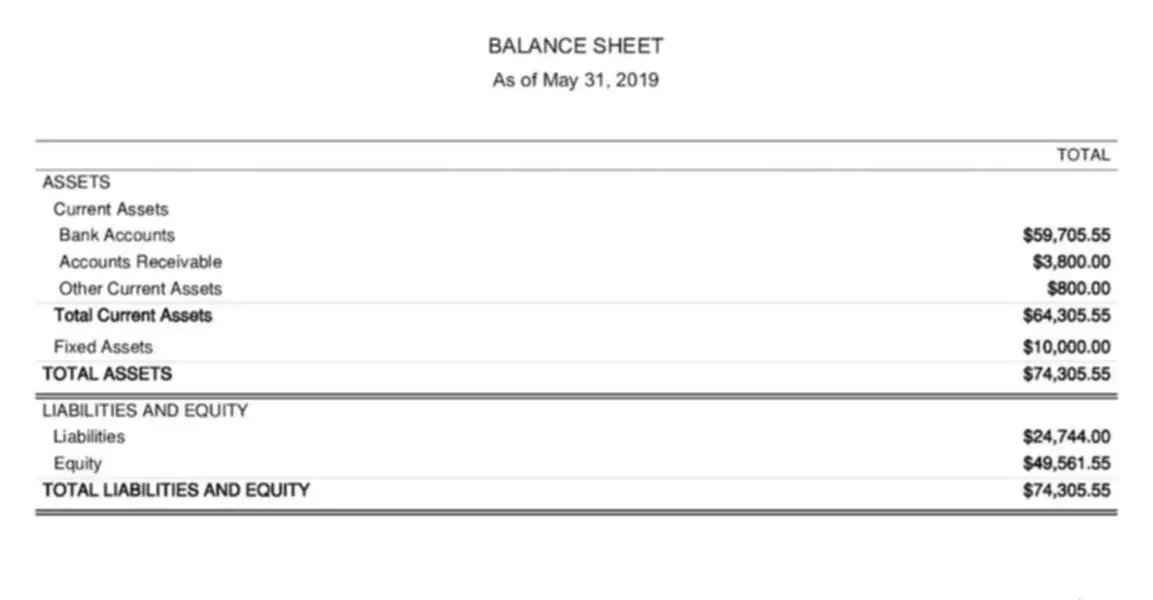

We save you money the moment you hire us by cutting out the expensive cost of hiring an in-house CFO. These examples show how these strategies can be applied in different industries and can lead to significant success. It’s necessary to have a clear vision and mission that resonates with employees, as well as competitive compensation and benefits packages. It’s important to have a clear understanding of your financials and to regularly monitor and adjust your spending to ensure profitability.

467 Stories To Learn About Aws – hackernoon.com

467 Stories To Learn About Aws.

Posted: Fri, 07 Apr 2023 07:00:00 GMT [source]

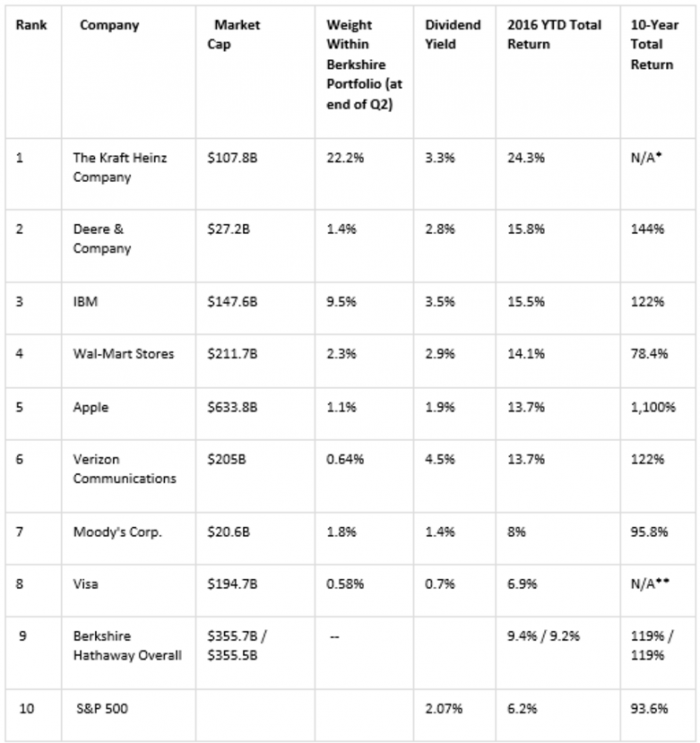

Snapchat, for example, went from zero to more than 100 million users and a valuation of $15 billion in less than five years. When a new teenager signs up and starts sending photos around, there’s little incremental cost to the company, so it can grow very quickly. Developing a sound strategy and tracking performance is critical in order to make informed decisions that can lead to growth and profitability.

Low Customer Acquisition cost (CAC)

Small Business Association; SCORE is a network of retired volunteer business mentors who guide startups at no cost. As you start to develop your business, you’ll want to have mentors you can trust, an advisory board steeped in experience and expertise. While navigating the entrepreneurial labyrinth, trusted mentors and proven startup programs will have the advice and guidance you need to find success. You could pledge, for example, that when the company hits its next profit milestone, you’ll give everyone a share of that profit. Incentives don’t have to be costly, either—you could give people extra time off, or any kind of non-monetary perk that you think they’d appreciate.

How to Find the Right Franchise for Your Personality – Entrepreneur

How to Find the Right Franchise for Your Personality.

Posted: Fri, 09 Dec 2022 08:00:00 GMT [source]

This rings true whether you’re a business with dozens of employees or a duo working out of a studio apartment. While some startups are easier to scale than others, all companies must grow. All businesses are created, born of passion and promise, aiming to develop into valuable entities able to scale successfully; they bring an exceptional return on investment for all parties involved. Approaching seasons of positive evolution as a startup – whether growth or scaling – requires tenacity and commitment, passion and people skills, and strategic utilization of time, energy, and resources. Social entrepreneurs are innovators whose main goal is to create products and services that both benefit the world, and make money. Social entrepreneurship relates to nonprofit, for-profit, or hybrid companies that are committed to social or environmental change.

High gross margins and Profits

However, these entrepreneurs have an intention to expand their business from the outset, unlike most small business entrepreneurs. Today, we know that the most successful companies have a vision beyond making money. They have a larger vision they’re working toward that the entire organization can engage with. This provides motivation for employees and creates storytelling opportunities for scaling. Now that we have more options than ever for logistics, startups need to consider all the options and be brutally honest about the scalability of any given product. If your product distribution is complex, you might want to rethink your offerings and/or business model.

Maximize the local meetups in your area, and integrate yourself into the business support groups that will empower you and your startup. Find the right individuals, fellow entrepreneurs, and friends, and lean on them for brainstorming, feedback, and constructive criticism. Building and maintaining an effective support network will ensure a sense of accountability and a wealth of insight and perspectives to keep you on track. You don’t have to move fast and break things, but an important lesson to take from startups in this area is that any business needs to adapt to change. As I mentioned, most business owners—not just startup founders—are extremely committed to their business, and they’re often very passionate about it.

Fabian Entrepreneur: Examples, Advantages and Characteristics

You need to find bookkeeper definition who are better than you at different aspects of the business. A diversified team will help you scale your business quickly because of the differences in skills and perspectives. Both Uber and Airbnb have implemented scaling strategies such as expanding into new markets by launching in new cities and countries. This can include things like strategic partnerships, joint ventures, or licensing agreements. It’s important to choose partners that align with your overall business strategy and can bring new customers, resources, or expertise to the table. It’s also important to consider scalability when building your team and infrastructure.

Implementing the four concepts below will significantly increase your chances of being the needle that masters the haystack. In this tutorial, you’ve seen that the definition of a startup is not just about being small or new, or about being a tech firm. It’s about a whole set of characteristics that differentiate startups from other businesses, from high growth and innovation right through to flexibility and a willingness to fail. This hiring will often take place at an earlier stage than with other businesses, sometimes when there’s nothing more than the idea to work from, and it also has a different focus. With a regular business, you’re often hiring people on an as-needed basis as the business grows, but startups often recruit people to bring their creativity in helping to refine the idea. If you open a café, you’re probably not aiming to overturn the café industry and rewrite the rules on how cafés are run.

Myths About Venture Capital, Debunked

There is a need to sharpen the skills and flying into the uncharted territory. There is a great sort of commitment asked by startups that ask tons of effort from entrepreneurs. Unless you’re creating a whole new market, your product needs to be able to “sell itself” and keep your marketing costs low.

Here, we’ll discuss the five types of entrepreneurs and how their respective priorities and goals create unique businesses and distinctly affect consumers. Large company entrepreneurs address the needs and opportunities of an existing business through innovation. You’re never too young to start exploring the worlds of electronics and engineering.

- One of the defining characteristics of successful startups is disruption.

- Consider scalability when developing your business model to ensure it can easily expand to new markets or add new product or service offerings.

- Human created issues sometimes call for innovative community-based solutions.

- It’s far better to bring in a piece of software in the early stages, allow your team to truly get to grips with it, and have it ready to wield when more business starts coming in.

And the online advertising landscape continues to evolve, challenging entrepreneurs to adapt in motion. New platforms, ad types, and targeting capabilities are popping up all the time. Define quality digital marketing as a cornerstone of your marketing strategy and business plan.

It’s important to ensure that new products or services align with your overall business strategy and address customer needs. Expanding into new markets can help a startup reach new customers and increase revenue. This includes individuals with expertise in sales, marketing, product development, and operations. This is the unique benefit or solution that your product or service provides to customers.

In this tutorial, I’ll give a basic definition of a startup, and then we’ll look at all the characteristics of startups one by one. As we explore them, you’ll learn some useful lessons that you can apply not just to startups but to any kind of business. When you look at all these factors together, it’s easy to see some common threads. They have a simple, powerful, values-based vision, and they work toward it every single day. Don’t make the mistake of only focusing on your product and the daily goals of the organization.