Forex Trading Strategies 2023: 8 Strategies That Work!

Content

Trades are executed in a matter of hours, if not minutes, and you usually cannot make high returns on any single one. However, a few trades every day will start to pile up if you do them right—and you will amass enough capital to make every trade count. After seeing an example of swing trading in action, consider the following list of pros and cons to determine if this strategy would suit your trading style. Trade times range from very short-term (matter of minutes) or short-term (hours), as long as the trade is opened and closed within the trading day. Forex trading requires putting together multiple factors to formulate a trading strategy that works for you. There are countless strategies that can be followed, however, understanding and being comfortable with the strategy is essential.

- This means borrowing one currency at a low rate and then investing in another currency that provides a higher rate.

- If you understand yourself, then you’ll understand which type of trading strategy is more likely to work for you.

- The strategy works if you wait for the price to break out of the consolidation zone and retest.

- By picking ‘tops’ and ‘bottoms’, traders can enter long and short positions accordingly.

- Understanding how economic factors affect markets or thorough technical predispositions, is essential in forecasting trade ideas.

This can be done manually or via an algorithm which uses predefined guidelines as to when/where to enter and exit positions. The most liquid forex pairs are preferred as spreads are generally tighter, making the short-term nature of the strategy fitting. To start investing in the currency market it is essential to know forex trading strategies. Having a plan allows you to trade responsibly by managing risk well and choosing investments that suit your risk profile and goals. Trading forex without a forex trading strategy is a bit like starting out on a trip without a map since you never know where your account will end up.

How To Profit From The Support And Resistance Strategy? ?

Click here for a full list of our partners and an in-depth explanation on how we get paid. Kane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, InsideBitcoins, Blockonomi, Learnbonds, Buysharesand the Malta Association of Compliance Officers.

- Scalpers also closely monitor price charts for patterns that can help them predict future exchange rate movements.

- Trading forex without a forex trading strategy is a bit like starting out on a trip without a map since you never know where your account will end up.

- If the answer to all these is yes, you usually have a steady upward trend on your hands and you can exploit it.

- The success of a breakout strategy depends on the trader’s ability to correctly identify key levels of support and resistance, and to enter and exit trades at the right time.

Intraday trading is risky, and traders should understand the risks and have a solid trading plan, risk management strategy, and disciplined approach. Overall, fundamental analysis is an important tool for forex traders to make informed decisions and improve their trading strategies. The EUR/USD 10 minute above shows a typical example of a scalping strategy. The long-term trend is confirmed by the moving average (price above 200 MA).

Forex Range Trading Strategy

The Forex Buy and Hold strategy is primarily used by investors who have a long-term view on the market and are looking to make a profit from the long-term trend of the currency pair. Of course, before starting out, you need to learn the basics of forex trading and master a number of essential skills such as technical analysis and fundamental analysis. From there you can assess the best Forex trading strategies to invest in currency pairs effectively and in line with your investment needs.

The article is checked by our editorial team, Which includes entrepreneurs who are painfully aware of how overwhelming and challenging it is to start a business for the first time. The price consolidated for a couple of days (each candle is 1-hour) and dropped below the consolidation box. If the price breaks above, the cloud will change to green, indicating a possible trend reversal to the upside. At the top is resistance (Senkou Span A) and at the bottom is support (Senkou Span B). For instance, a one-hour candle opens and moves above the previous candle for 45-minutes.

This acts as a sort of risk management tactic because investors are only exposed to one hour of trading per day, which should minimize their losses. Forex range trading strategy is a trading technique that focuses on identifying and trading within a defined price range or channel of a currency pair. This strategy is suitable for traders who prefer a more conservative approach and are comfortable with trading in a range-bound market.

Forex Day Trading Strategies

For example, at eToro, you can copy a seasoned trader like-for-like and know that the data in front of you is 100% valid. In other words, you can view stats surrounding the trader’s historical performance, preferred forex pairs, average trade duration, and risk level. The number of pips that the pair moves by will ultimately determine how much you make or lose.

If your strategy works, proceed to trading in a demo account in real time. If you take profits over the course of two months or more in a simulated environment, proceed with day trading with real capital. In addition to knowledge of day trading procedures, day traders need to keep up with the latest stock market news and events that affect stocks. This can include the Federal Reserve System’s interest rate plans, leading indicator announcements, and other economic, business, and financial news. Individual investors are increasingly trying their hand at foreign exchange trading, also known as forex or FX.

#1 Position trading – Holding positions for an extended period of time (months and years). This kind of forex trading is reserved for the ultra-patient traders, and requires a good eye to be able to spot the underlying long term trend. ️ This is the polar opposite of day trading as short term fluctuations are not taken into account when position trading. Forex trading strategies can be based on technical analysis or fundamental, news-based events.

Different Types of Lot Sizes in Forex Trading Explained

However, if the market doesn’t reach your price, your order won’t be filled and you’ll maintain your position. Currencies trade in pairs, with a pair representing the exchange rate between the two components. EUR/USD, for example, references the relationship between the euro and the U.S. dollar. In forward contracts, the buyer and seller agree to an exchange at some future date, on negotiated terms. This is an over-the-counter instrument that’s typically non-transferable. Futures FX contracts, on the other hand, are standardized and can be publicly traded.

These factors aid in determining the timing of trades, the number of positions to open, and the division of time between market research and monitoring of active positions. Nonetheless, the subsequent list outlines trading strategies tailored for the forex market, which are founded on significant levels of support and resistance. The “Buy the Rumor, Sell the News” Strategy is a popular trading approach in the foreign https://g-markets.net/helpful-articles/engulfing-candlestick-pattern/ exchange (forex) market. This strategy involves taking advantage of market sentiment by buying or selling a currency pair based on the expectation of a future event or news announcement. As a result, the value of the currency can rise in anticipation of the event. In other words, you’ll be able to actively enter and exit positions throughout the day – as opposed to taking a more passive approach via swing trading.

By smoothing price, it helps to filter the noise of short term price spikes that distract you from the overriding trend. Trading an advanced trading strategy does not necessarily mean you’ll make more money. Investopedia does not provide tax, investment, or financial services and advice. The price movement tags the horizontal resistance and immediately rotates lower.

Now, you will notice that both short-term and long-term traders require a large amount of capital – the first type needs it to generate enough leverage, and the other to cover volatility. Although these two types of traders exist in the marketplace, they are comprised of high-net-worth individuals, asset managers or larger institutional investors. For these reasons, retail traders are most likely to succeed using a medium-term strategy. From there, new traders might feel more confident to open another live account, experience more success, and break-even or turn a profit. That is why it’s important to build a framework for trading in the forex markets, which we outline below.

Forex Scalping Strategy

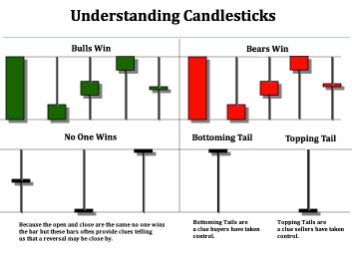

Support is when a downward trend is forecasted to pause because of growing demand. Resistance occurs when an upward trend is expected to slow because of a growing supply. Wait for a better price and take the trade, taking some profits as the trade gains momentum. Move your stop loss to breakeven and allow the trade to play out to its conclusion.