Adjustments to Retained Earnings on Income Statements

DividendsDividends refer to the portion of business earnings paid to the shareholders as gratitude for investing in the company’s equity. Retained earnings it is important to keep in mind, allowing us to estimate the amount of net income a company has left over after paying shareholders dividends . We will try to address as many situations/variations in these examples, but these situations are not fully exhaustive, and it is possible to encounter the ones that vary from those given below. However, one must remember that the core reasoning and concept behind retained earnings statements remain the same.

Lakeland Industries, Inc. Reports Fiscal 2023 Fourth Quarter and … – AccessWire

Lakeland Industries, Inc. Reports Fiscal 2023 Fourth Quarter and ….

Posted: Thu, 13 Apr 2023 17:07:27 GMT [source]

Looking at the income statement columns, we see that all revenue and expense accounts are listed in either the debit or credit column. This is a reminder that the income statement itself does not organize information into debits and credits, but we do use this presentation on a 10-column worksheet. Service Revenue had a $9,500 credit balance in the trial balance column, and a $600 credit balance in the Adjustments column.

Retained Earnings Ratios

Taggert Company paid $1,800 for a 6-month insurance premium on December 1. Which of the following statements are correct regarding the accounting for this insurance over the six-month period? Retained earnings are considered to be part of the equity section on a company’s balance sheet and not assets. How to Find Negative Retained Earnings in a 10-K – Does it Indicate Distress? Stockholders’ equity, also called book value, is the company’s assets minus its liabilities.

Talos Energy : ENVEN ENERGY CORPORATION AND SUBSIDIARIES – Form 8-K – Marketscreener.com

Talos Energy : ENVEN ENERGY CORPORATION AND SUBSIDIARIES – Form 8-K.

Posted: Wed, 12 Apr 2023 21:25:19 GMT [source]

Some companies use their retained earnings to repurchase shares of stock from shareholders. You might go this route for various reasons, such as increasing existing shareholders’ ownership stake or reducing the number of outstanding shares. Retained earnings represent a critical component of a company’s overall financial health, as they indicate the profits and losses the company has retained. Before we talk about a statement of retained earnings, let’s first go over exactly what retained earnings are. Retained earnings are a portion of the net profit your business generates that are retained for future use.

For Creditors

Unless an exception arises it should continue to retain earnings as the chief form of sourcing of https://1investing.in/. As it is majorly carried out on a single time period, Vertical analysis is also known as static analysis. Results from vertical analysis over multiple financial periods can be particularly useful while conducting regression analysis. Accountants see relative changes in company accounts over a given period of time and determine the best strategy to improve the relationship between financial items and variables. Other financial statements are also considered during Horizontal Analysis but these two statements are generally sufficient enough to provide appropriate insights into a company’s financial health.

- Likewise, both the management as well as the stockholders would want to utilize surplus net income towards the payment of high-interest debt over dividend payout.

- He was the environmental issues columnist at the “Oregon Daily Emerald” and has experience in environmental and land-use planning.

- Normally, these funds are used for working capital and fixed asset purchases or allotted for paying off debt obligations.

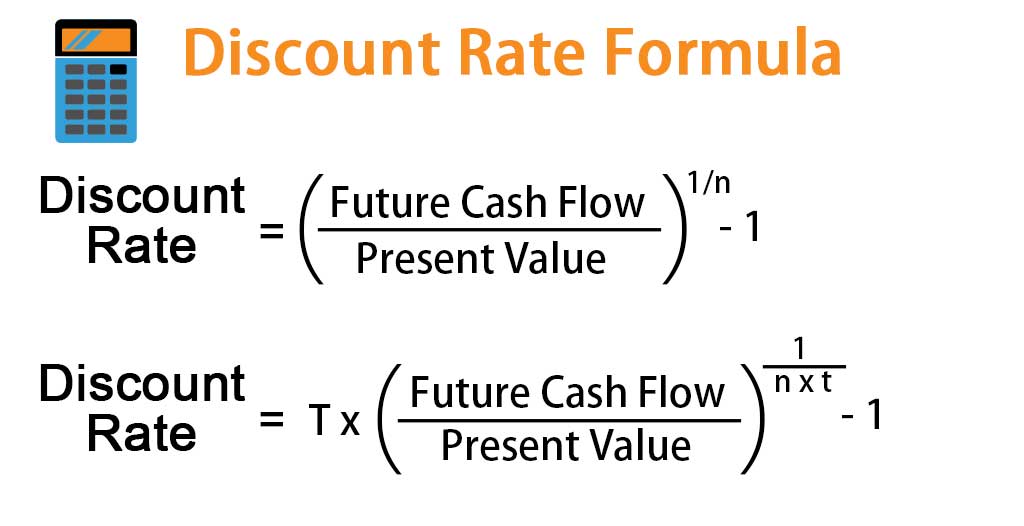

Investors and lenders might want to look at your income statement to see how stable your business’s finances are. After all, they want to make sure your business is healthy before investing in your company. You can use an income statement to look at your profits and losses on a weekly, monthly, quarterly, or annual basis. This cost of retained earnings should be compared with the cost of raising debt from the market and the decision to limit the percentage of retention should be taken accordingly. Rather than an item in the statement, a whole accounting period is used as the base period and its items are used as the base elements in all comparative statements.

Horizontal vs Vertical Trend Analysis

By subtracting the dividends paid from the net income, you can see how much profit the company has reinvested in itself. By looking at these items, you can understand a company’s performance over time and dividend policy. Many businesses use retained earnings to pay down debt, which can help to improve a company’s financial health and reduce its interest expenses. If you decide to reduce debt, you should prioritize which debts you’ll pay off. While they may seem similar, it is crucial to understand that retained earnings are not the same as cash flow. Retained earnings represent the profits a business generates over time, while cash flow measures the net amount of cash/cash equivalents coming and and out over a given period of time.

- Your total assets should equal your total liabilities and equity.

- However, one must remember that the core reasoning and concept behind retained earnings statements remain the same.

- If the amount is not determinable, the reporting entity generally describes the transaction.

- Remember that the balance sheet represents the accounting equation, where assets equal liabilities plus stockholders’ equity.

To get the $10,100 statement of retained earnings balance in the adjusted trial balance column requires adding together both credits in the trial balance and adjustment columns (9,500 + 600). Once all accounts have balances in the adjusted trial balance columns, add the debits and credits to make sure they are equal. If you check the adjusted trial balance for Printing Plus, you will see the same equal balance is present.

Multiply your net income by the retention rate

Typically, the net profit earned by your business entity is either distributed as dividends to shareholders or is retained in the business for its growth and expansion. Your retained earnings can be useful in a variety of ways such as when estimating financial projections or creating a yearly budget for your business. However, the easiest way to create an accurate retained earnings statement is to use accounting software. Keep in mind that if your company experiences a net loss, you may also have a negative retained earnings balance, depending on the beginning balance used when creating the retained earnings statement. The statement is most commonly used when issuing financial statements to entities outside of a business, such as investors and lenders.

Use your net profit from your income statement to prepare your statement of retained earnings. After you gather information about your net profit or loss, you can see your total retained earnings and how much you’ll pay out to investors . Your business’s financial statements give you a snapshot of the financial health of your company. Without them, you wouldn’t be able to monitor your revenue, project your future finances, or keep your business on track for success.

5 Prepare Financial Statements Using the Adjusted Trial Balance

For example, a corporation might declare a $3 dividend on its 100,000 outstanding shares, which means that it has declared $300,000 dividends, or $3 per share. Net income is equal to revenues minus expenses and is the bottommost listing on the corporation’s income statement. The accumulated retained earnings balance for the previous year, which is the first line item on the statement of retained earnings, is on both the balance sheet and statement of retained earnings. The statement of retained earnings might also be known as the statement of owner’s equity, an equity statement, or statement of shareholders’ equity.

The statement of retained earnings is a sub-section of a broader statement of stockholder’s equity, which shows changes from year to year of all equity accounts. If your statement of retained earnings is positive, you have money to invest in assets for your business or pay off debts. You can either add your statement of retained earnings to your balance sheet. Your statement of cash flows can show you the timing in which money comes in and goes out of your business. By tracking your cash flow, you can create a cash flow forecast and help predict future cash flow. The investments portion of your cash flow statement shows purchases or sales of long-term assets.

The retention ratio helps investors determine how much money a company is keeping to reinvest in the company’s operation. If a company pays all of its retained earnings out as dividends or does not reinvest back into the business, earnings growth might suffer. Also, a company that is not using its retained earnings effectively have an increased likelihood of taking on additional debt or issuing new equity shares to finance growth. One piece of financial data that can be gleaned from the statement of retained earnings is the retention ratio. The retention ratio is the proportion of earnings kept back in the business as retained earnings.

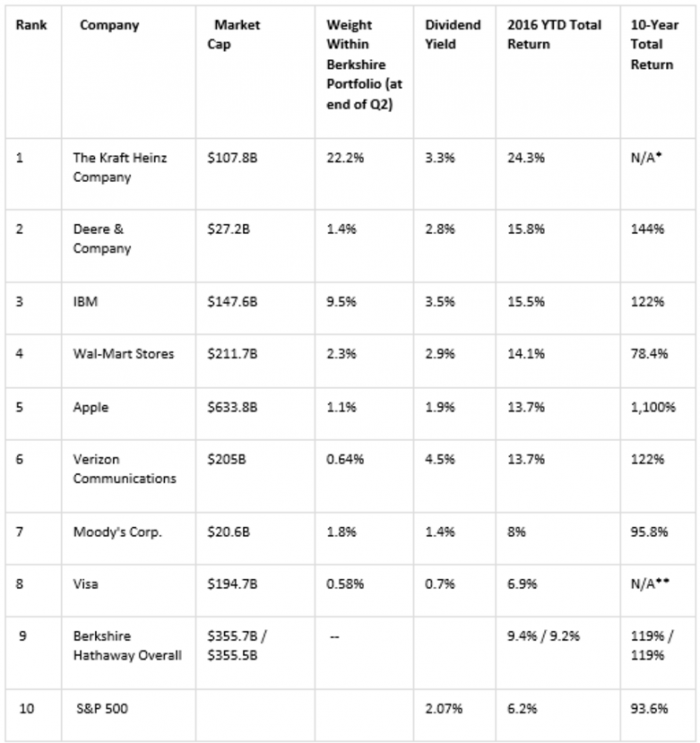

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. For example, during the period from September 2016 through September 2020, Apple Inc.’s stock price rose from around $28 to around $112 per share. Companies may choose to use their retained earnings for increasing production capacity, hiring more sales representatives, launching a new product, or share buybacks, among others.

The retained earnings account balance as per adjusted trial balance of the company was $3,500,000. During the year Nova declared and paid a divided of $250,000 to its stockholders. On January 1, 2021, the company had 500,000 shares of $10 par value common stock and 50,000 shares of $100 par value preferred stock outstanding. The number of shares remained unchanged throughout the year as Nova did not make any new issue during 2021.